The health of any organization is determined by the health of its finances. This is why qualified and competent accountants and other finance professionals are indispensable to any organization. Accountants may be required to analyze financial records, prepare and audit financial statements, and to give advice related to accounting systems and operations and other financial matters.

The demand for accountants, auditors and other accounting professionals is rising, possibly fueled by globalization, a growing economy, and tax and regulatory complexities. According to the Bureau of Labor Statistics (BLS), the employment of accountants and auditors is predicted to grow 10 percent from 2016 to 2026, faster than the average for all occupations.

An online degree in accounting may help students develop the financial acumen they need to succeed in accounting professions. Students may develop essential skills in math, analysis, organization and communication. Individuals who like to work with data, solve problems, lead projects and have the ability to make decisions may find a career in accounting fulfilling.

Career paths in accounting by degree level

With the right qualifications, graduates with online degrees in accounting may secure positions as accountants, auditors, financial analysts, financial managers and so on. Individuals interested in careers in accounting may choose degree programs based on their career aspirations as well as the time and money they are able to commit to investing.

Accountants and Auditors

Accountants and auditors primarily handle financial records and taxes. Their employment is expected to grow 10 percent from 2016 to 2026, adding about 139,900 jobs.

Degree level required: These occupations typically require at least a bachelor’s degree in accounting or a related field. Some employers may prefer master’s degree graduates. Certifications such as certified public accountant (CPA) and certified information systems auditor (CISA) may help to enhance career prospects.

Financial Analysts

Financial analysts examine the performance of various investments and provide guidance in making investment decisions. An 11 percent rise in the employment of financial analysts from 2016 to 2026, adding about 32,000 jobs, is predicted by the BLS.

Degree level required: A bachelor’s degree in accounting or in a similar field is usually required. A license is generally required to sell financial products. An additional certification as a chartered financial analyst (CFA) may help advance one’s career.

Financial managers

Financial managers generally develop strategies and plans for the long-term financial goals of their organization. Their employment is expected to grow 19 percent from 2016 to 2026, adding about 108,600 jobs.

Degree level required: A bachelor’s or master’s degree in accounting, finance, economics, or business administration is typically required for financial managers. Further certification such as chartered financial analyst (CFA) or certified treasury professional are an asset.

Bookkeeping, Accounting, and Auditing Clerks

They typically prepare financial records for businesses and other organizations and are expected to continue to be in demand.

Degree level required: Individuals with some postsecondary education and equipped with basic math and computer skills, including knowledge of spreadsheets and bookkeeping software, may be eligible for these roles. Most technical skills can be acquired on the job. Some clerks may seek certifications such as those of certified bookkeeper (CB) or certified public bookkeeper (CPB).

Financial clerks

Financial clerks typically carry out administrative tasks such as maintaining financial records, conducting financial transactions and aiding customers in the same. Around 127,900 jobs are expected to become available from 2016 to 2026.

Degree level required: Individuals with a high school diploma or an equivalent qualification may be eligible to apply for positions as financial clerks.

How to become an accountant

To become an accountant, you may need to graduate from an accredited institution with a degree in accounting or in a subject such as business administration with a concentration in accounting. You may gain practical experience through internships with public accounting or business firms.

You may be required to obtain appropriate licensure or certification that qualifies you to perform specific responsibilities. Certification may enable you to practice a specific specialty or advance to more senior positions. Accountants who file reports with the Securities and Exchange Commission (SEC) are legally required to be Certified Public Accountants (CPAs).

In some cases, junior level accounting professionals may acquire skills on the job and advance to more senior roles based on their experience.

How can you earn an accounting degree online?

The coursework required for most accounting degrees is theoretical. Therefore, a degree in accounting may be acquired conveniently in an online format. This allows participants the flexibility to attend to professional or family commitments while pursuing their education.

Most classes are conducted asynchronously. Students may access relevant course materials including videos through the institution’s online learning platform. Assignments usually have deadlines. Some courses may require occasional real-time online attendance for peer discussions or tutorials. Some degree programs may require students to complete an internship or work experience at an approved organization.

Many colleges and universities that offer accounting degree programs through distance education may provide online students with access to a digital library, counseling services, tutoring, and career guidance. You can look up various online degree programs in accounting on the Internet and compare the curricula, tuition and student support services available or you can visit our page on online accounting degree programs and check out our ranking of the best online colleges for accounting.

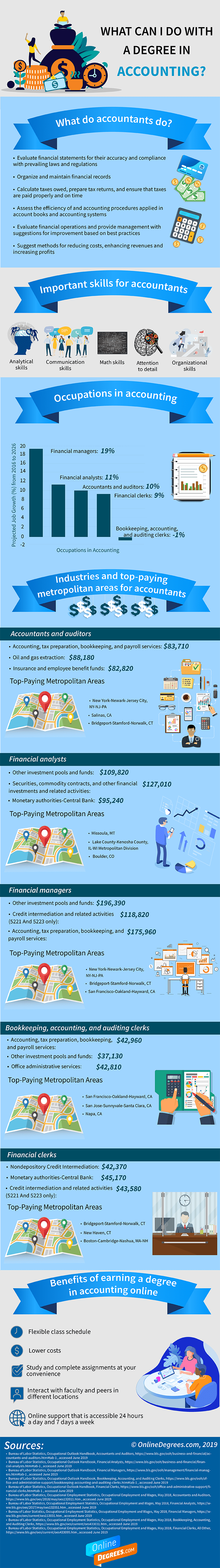

Learn more about careers in accounting with the help of the infographic below.

Sources

- Bureau of Labor Statistics, Occupational Outlook Handbook, Accountants and Auditors, https://www.bls.gov/ooh/business-and-financial/accountants-and-auditors.htm#tab-1 , accessed June 2019

- Bureau of Labor Statistics, Occupational Outlook Handbook, Financial Analysts, https://www.bls.gov/ooh/business-and-financial/financial-analysts.htm#tab-1 , accessed June 2019

- Bureau of Labor Statistics, Occupational Outlook Handbook, Financial Managers, https://www.bls.gov/ooh/management/financial-managers.htm#tab-1 , accessed June 2019

- Bureau of Labor Statistics, Occupational Outlook Handbook, Bookkeeping, Accounting, and Auditing Clerks, https://www.bls.gov/ooh/office-and-administrative-support/bookkeeping-accounting-and-auditing-clerks.htm#tab-1 , accessed June 2019

- Bureau of Labor Statistics, Occupational Outlook Handbook, Financial Clerks, https://www.bls.gov/ooh/office-and-administrative-support/financial-clerks.htm#tab-1 , accessed June 2019

- Bureau of Labor Statistics, Occupational Employment Statistics, Occupational Employment and Wages, May 2018, Accountants and Auditors, https://www.bls.gov/oes/2018/may/oes132011.htm , accessed June 2019

- Bureau of Labor Statistics, Occupational Employment Statistics, Occupational Employment and Wages, May 2018, Financial Analysts, https://www.bls.gov/oes/2017/may/oes132051.htm , accessed June 2019

- Bureau of Labor Statistics, Occupational Employment Statistics, Occupational Employment and Wages, May 2018, Financial Managers, https://www.bls.gov/oes/current/oes113031.htm , accessed June 2019

- Bureau of Labor Statistics, Occupational Employment Statistics, Occupational Employment and Wages, May 2018, Bookkeeping, Accounting, and Auditing Clerks, https://www.bls.gov/oes/current/oes433031.htm , accessed June 2019

- Bureau of Labor Statistics, Occupational Employment Statistics, Occupational Employment and Wages, May 2018, Financial Clerks, All Other, https://www.bls.gov/oes/current/oes433099.htm , accessed June 2019